LPL Nashville

Financial Planning Services

What We Offer

Financial Planning Services

The LPL Financial team is here to help you focus on current financial needs and to prepare for what may be coming down the road. It's our business to know what's coming next, to look at life-changing events and ongoing needs. We help you find the right approach at every stage in your life. By keeping up with what's available in the industry, as well as changing laws and regulations, we update your portfolio to match your objectives.

LPL's Financial Planning Services Include:

- Family & Individual Wealth Management

- Insurance Evaluation (Life, Sports & Entertainment, Trust)

- Comprehensive or Goal-Based Financial Plan

Our Process

The Investment Management Process

LPL's approach to new clients begins with ascertaining your needs through a discovery process. We do this through a confidential survey of your assets, that allows us to develop a comprehensive financial plan. In this plan, we will also recommend an asset allocation that reflects your objectives. After we implement the plan, LPL continues to monitor the plan and follow the progress, meeting with you regularly to make any necessary adjustments over time to allow for changing market conditions or life circumstances.

Learn More

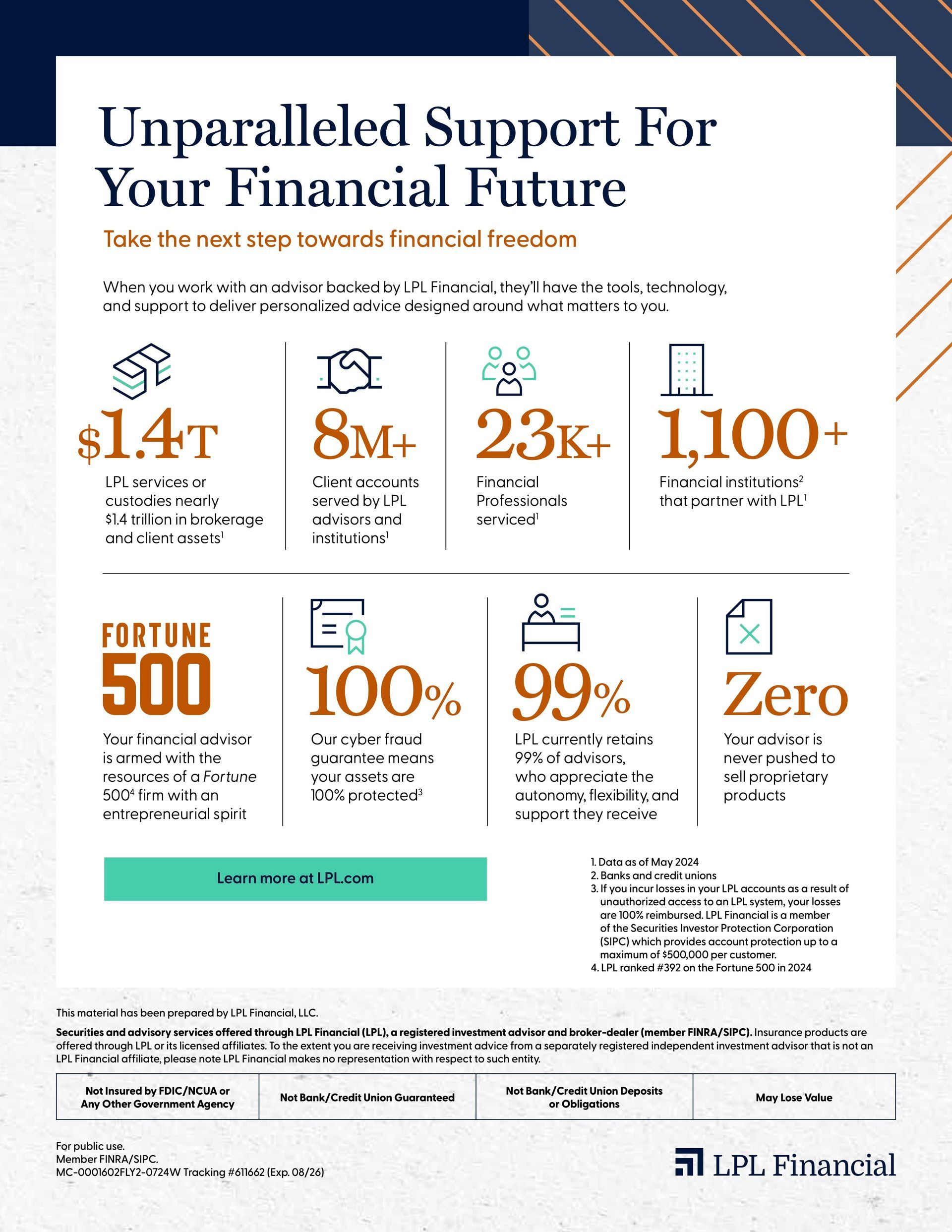

Why Is LPL Financial Fee Based

You may wonder why LPL charges a fee for their services when some other firms will offer seemingly free financial advice. Because we have no proprietary products or research, the firm is free to recommend the products and services that are best suited to each individual client's specific needs. That means you are paying for unbiased professional advice that truly benefits you, and are being served by experts with only your best interests in mind.

No Conflict of Interest LPL's recommendations are based solely on what's in your best interest. We have no proprietary products. We make no markets in stocks, we do no investment banking and have no proprietary research. We work for you, not a corporation.